Are you looking for best Job search websites in Tanzania.? In this article we have prepared a list of six (6) best job search websites in Tanzania, these websites will help you find jobs or employment in Tanzania.

Zoom Tanzania

Zoom Tanzania is a website that will give you the ability to get jobs from different parts of Tanzania, Find the best jobs in Tanzania on Zoom Tanzania. We have a wide variety of jobs available, from Fresher to Senior positions..

Mabumbe

If you are one of the people who are currently looking for a job in Tanzania, then I urge you to also make sure you visit the mabumbe website, this website advertises job opportunities every day including various scholarships as well as job opportunities in neighboring countries such as Zambia, as well as Kenya .

Ajira Yako

If you are a long-term job seeker, then make sure you visit this Ajira Yako website every day, this website posts new jobs every day, including scholarships, internships and admissions. So if you want a job quickly then make sure you visit this website every day.

Ajira Leo

Ajira Leo is one of the best job sites in Tanzania, the beauty of this site comes from announcing new jobs every day. If you are one of the people who are looking for official employment here in Tanzania then this website is very good to visit every day.

Udahili Portal

Udahili Portal is another website that is good for finding jobs here in Tanzania, this website is like the other websites mentioned above but this one focuses more on the combination of employment and education in Tanzania. Through this website you will be able to check new job opportunities every day, as well as scholarship opportunities, and admission.

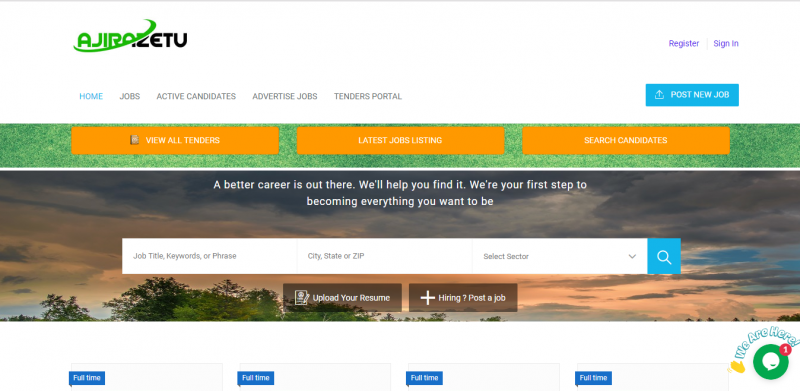

Ajira Zetu

The last site on this list is ajira zetu, this site is not very different from the previous sites because through here you will be able to find jobs that are added every day. You can apply for these jobs directly or through websites that advertise jobs.

And those are some of the websites that you can visit every day to look for employment or jobs in Tanzania.